If you have gone to buy milk recently or paid your child’s school fees, you might have felt a pinch in your pocket. You are paying more today for the exact same thing you bought last year.

This invisible force that quietly eats away the value of your money is called Inflation.

In this blog, we will break down what inflation is, how it works in India, and why your ₹100 note isn’t worth what it used to be.

Table of Contents

ToggleWhat is Inflation?

In technical terms, inflation is the rate at which the prices of goods and services rise over time.

In simple words: Inflation means your money is losing its “buying power.”

Imagine this:

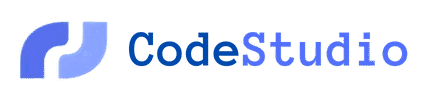

2015: You could buy a movie ticket, a popcorn combo, and pay for parking with ₹500.

2025: That same ₹500 might only cover the movie ticket. You need extra money for the popcorn and parking.

Imagine this:

2015: You could buy a movie ticket, a popcorn combo, and pay for parking with ₹500.

2025: That same ₹500 might only cover the movie ticket. You need extra money for the popcorn and parking.

The movie theater hasn’t changed. The popcorn hasn’t changed. But the value of your ₹500 has gone down. That is inflation.

Also Read: The Economics of Cricket World Cup Victory

Examples of Inflation in India (2024-2025)

To understand inflation, let’s look at items every Indian household relates to. It’s not just about “numbers”; it’s about your daily life

1. The “Amul Milk” Effect In May 2025, Amul increased milk prices by approximately ₹2 per litre. While ₹2 might seem small, it adds up. If a family buys 2 litres daily, that’s an extra expense of roughly ₹1,400+ per year just for milk. This is a classic example of rising food costs affecting monthly budgets.

2. The “Tomato” Rollercoaster In late 2025, tomato prices in many Indian cities surged by 50% to 100% in just a few weeks due to unseasonal rains affecting supply. When essential vegetables become expensive, your entire kitchen budget gets disturbed.

3. The Silent Killer: School Fees Inflation isn’t just about food. Education inflation in India is rising much faster than general inflation. Recent surveys suggest that private school fees in India have hiked by 50-80% in the last three years alone. This is often called “Lifestyle Inflation”—where services become costlier than goods.

Also Read: Quick Commerce Profitability

How is Inflation Measured in India?

You might hear news anchors shouting about “WPI” and “CPI.” What do they mean?

India uses two main rulers to measure inflation:

1. WPI (Wholesale Price Index): This measures the price rise at the factory or wholesale level. It matters to businessmen and traders. If steel or cement prices go up, WPI goes up.

2. CPI (Consumer Price Index) – This matters to YOU: This measures the price rise at the retail shop level. It tracks the “basket” of items a common Indian family buys—food, fuel, housing, clothing, and education.

When the government says “Inflation is down,” they are usually looking at CPI.

The Paradox: Sometimes CPI is low (like in late 2025 when it dipped below 1%), but you still feel prices are high. This is because while onion prices might be low, school fees or mobile recharges (which saw 10-15% hikes) are still high.

When the government says “Inflation is down,” they are usually looking at CPI.

The Paradox: Sometimes CPI is low (like in late 2025 when it dipped below 1%), but you still feel prices are high. This is because while onion prices might be low, school fees or mobile recharges (which saw 10-15% hikes) are still high.

Why Does Inflation Happen?

According to experts at BlackRock, inflation is usually caused by three things:

- Demand-Pull (Too much money, too few goods): Imagine there is only one iPhone left in a shop, but 10 people want to buy it. The shopkeeper will raise the price. In India, during festivals like Diwali, demand rises, and so do prices.

- Cost-Push (Making things gets expensive): If the price of petrol/diesel goes up (as we often see in India), the truck driver charges more to transport vegetables. The vegetable vendor then charges you more to cover his transport cost.

- Built-In Inflation (The Cycle): When prices rise, employees ask for salary hikes. To pay higher salaries, companies raise the prices of their products. It becomes a cycle.

Is Inflation Bad?

Not always. A little bit of inflation (around 4% in India) is actually considered healthy because it shows the economy is growing and people are spending.

However, when inflation rises faster than your salary (like the school fee example), it becomes a problem.

How to beat it? Keeping cash in a savings account (which gives ~3% interest) means you are losing money if inflation is 5%. To stay ahead, Indians are increasingly looking at investments like Mutual Funds, Gold, or Stocks that historically beat inflation over the long run.